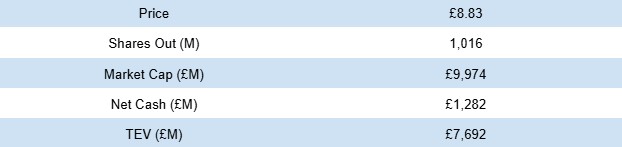

Wise plc (WISE.L)

Founder-led and owned business with significant moats sharing back the scale benefits with customers "Costco style" while growing at double digits and trading at a reasonable multiple.

Wise plc is the fintech cross-border payment network and platform whose sole mission is to bring down the FX fees and the international payment time to zero. The company is founder owned and led by Kristo Kaarmann and runs on economies of scale, aiming to reinvest all of its earnings into lowering cross-border fees (Costco/Amazon style) and drive more volume in return. This is enabled by its proprietary network, huge capital constraints in their unique model that bypasses SWIFT rails and legislative barriers in the countries it has direct access to. Recently, the company lowered prices for customers and drove more volume, which was taken in a negative light by Wall Street. Just like Costco and Amazon in the early 2000s, Wise seems to be misunderstood and its potential downplayed. Check out my 13-page deep dive.

Business Overview

Origins

Wise plc, formerly known as TransferWise is an international payments business and platform founded in 2011 in London by two Estonians, Kristo Kaarmann and Taavet Hinrikus. Both lived and worked in Lonon, Hinrikus at Skype and Kaarmann at Deloitte. However, Hinrikus made money in euros (Skype was originally Estonian) and had all his expenses in pounds. Meanwhile, Kaarmann was paid in pounds, but had a mortgage back in Estonia for which he needed euros.

They met at a party and after sharing their issues of banks charging them 5% to move the money between the UK and Estonia, they agreed to move money between their own accounts without having to make international transfers. Hinrikus moved euros from his Estonian account to Kaarmann’s Estonian account and Kaarmann moved the equivalent at the official FX exchange from his British account to Hinrikus’ British account. This way they managed to dodge the FX mark-ups that banks like to charge on international transfers partly to cover SWIFT costs and partly to make a profit.

They kept sending money to each other this way and with time as their private network grew, realised that the model was scalable. This led them to set-up wise and this “liquidity management” without having to process the money internationally became the cornerstone strategy of their new start-up.

In 2012, Wise’s first year of operation, the company processed a total of 10 million euros, which then grew to £1 billion in 2017 and the current cross-border volume of £145.2 billion (2025). The average cross-border take at Wise is 0.58%, while banks typically charge between 2% and 5%. This is because when HSBC or any other banks send the money internationally, it has to go through a centralised treasury function and multiple third-party institutions along the SWIFT rails.

However, if you send the money from GBP to PLN, Wise has registered operations in each of the countries, holding substantial balance sheets in each of the currencies. It takes out the money from your GBP account and then adds the equivalent (after a tiny fee) to your PLN accounts, both within the Wise proprietary network. That’s why you typically get your money with Wise within seconds, while Wise has to rebalance their currency holdings, and they still run the same process, but they essentially have a 48-hour worth of payment float.

(Kristo Kaarmann & Taavet Hinrikus)

Essence of Wise

One thing you should keep in mind here is that international transfers are asymmetric, meaning that there is typically much more money coming to country A from country B than vice versa. Because of it, Wise enters every single market locally, obtains the license and builds out the infrastructure, establishing a large cash pool in that currency. This strategy is extremely capital-intensive as you always need more currency float, and the bigger the float, the better you can manage the fluctuations arising from the payment asymmetry. You end up building your own market with multicurrency accounts worldwide that fluctuate widely, and the larger it gets, the lower your processing cost and the faster your transactions.