Inter Cars S.A. (CAR.WA)

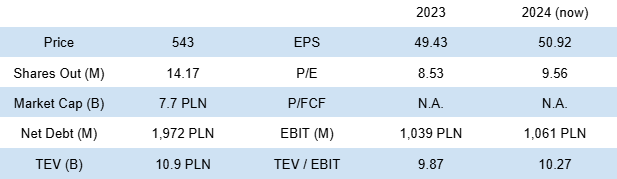

CEE auto parts market leader growing its market share in a highly fragmented and consolidating market. This underfollowed Polish compounder providing an essential service is selling for a p/e of 9.6x.

The largest auto parts supplier in Poland and CEE, and the second largest in Europe, is growing its market share in a highly fragmented market as the smaller regional players are going bankrupt. The company provides an essential service, so the customers of the bankrupt companies are going to Inter Cars, thereby reinforcing the cycle. Inter Cars is an overlooked Polish compounder that has grown steadily over the years and is sometimes overshadowed by the investor darling Auto Partner. Inter Cars has a significant long-term moat over Auto Partner, stemming from their business models being vastly different.

The company has been quietly growing and expanding its network all across the CEE, running a franchise-like system. It has aggressively invested in growth and is catching up to its biggest competitor, LKQ. The business is also family-owned and run, with the second-generation CEO in charge and a 26.3% Oleksowicz family stake in the business. My thesis is that Inter Cars, and not Auto Partner, is poised to be the long-term winner in the European independent aftermarket. Read my 20-page deep research dive into the company to find out why!

Business overview

Inter Car S.A. is the largest auto parts supplier both in Poland and Central and Eastern Europe (CEE). It’s also the second largest in Europe after the American consolidator LKQ that operates mostly in Western Europe, whilst Inter Cars has been primarily focused on CEE. The company buys spare car parts from many diversified suppliers, which it then sells to its customers, of whom 74% are individual or small mechanic repair workshops. The remaining 26% of the revenue is split amongst the sales to retail 3rd parties in Poland and various miscellaneous revenue streams like car rentals, etc, which are a few % of revenue each. The important part and what we will be focusing on is the 74% (90% if you include local retail).

Inter Cars operates a network of big distribution centres throughout all of its geographies (Baltics, Poland, Czechia, Slovakia, Hungary, Romania, Balkans, etc.). These serve as central hubs or “mid-hubs” and then supply the parts to the franchisee partners of Inter Cars. The company itself only owns a few big hubs (typically one or max two per country), and the branches are run by owner operators on a franchise basis. Inter Cars provides them with the inventories, basic fit-out, ERP systems, etc.

The franchisees, who are typically local entrepreneurs with a good knowledge of their markets (Hungary, Romania, etc), then sell and supply the parts to the repair workshops on a just-in-time basis. The company does not share the bonuses from suppliers with the franchisees. They simply share the profits 50/5,0 and any after-sales bonuses obtained from suppliers aren’t shared with franchisees.

“First of all, you will free the money that you currently have frozen on the shelves, because from now on, the warehouse will be fully financed by Inter Cars, and the goods will move automatically. You will not have to wonder what you are missing and where to get the funds to expand the assortment; we will provide you with the entire system. You will increase your turnover, and you will sleep soundly.” - Inter Cars Founder and ex-CEO

Other than a few exceptions, like Czechia, all of the branches are franchised. There are 30 franchisees in Poland (246 branches), and the biggest partner has 15% of domestic sales.

The franchisee-run branches are 99% rented from external parties. In some cases, Inter Cars leases the property to the franchisee on a 10-year lease. This creates skin-in-the-game (Taleb) as the franchisee is invested in Inter Cars. Franchisees can also sell only Inter Cars products and are prohibited from selling any non-company ones. The company also typically subleases the branch, placing itself between the owner and the franchisee operator so that it can control the process.

All products sold go to the topline, and Inter Cars doesn’t consolidate franchisees because they don’t influence the partners’ financial policy, dividends, profits, etc. On the Inter Cars’ income statement, the distribution fee is the cost, which is correlated to the gross profit. The more gross profit the franchisee generates, the more Inter Cars has to pay him for the distribution services. As such, the partners earn only when they make sales, and they have to maximise the gross profit because of it.

Motointegrator and Q-service are two auxiliary parts of the business model worth mentioning. Motointegrator is an aggregator website that lets you find the closest repair workshop that’s part of the Motointegrator system. Repair workshops find it useful as it generates new customers for them when they join the network. Q-service is a premium network of repair workshops (mostly trucks), which guarantees the highest quality of service to the customers alongside other benefits and is a brand customers trust. It’s currently the largest service network for commercial vehicles in CEE.

(Local Q-service member repair workshop in Poland)

All analysis of a moat (competitive advantage) should start from a clear definition of the customer and the unique value proposition that your product or service provides them with. First, you need to understand the European car repair market. It’s very unlike the one in the US, where people like to do DIY repairs, and there is plenty of space to store the cars. In Europe, people often live in smaller flats in big apartment blocks. As such, they often don’t have their own garage where they can store their car, as the space is limited and population density is high.