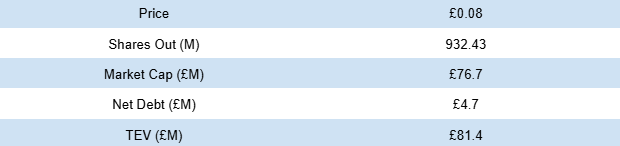

DP Poland Plc (DPP.L)

Polish master franchisee and designated operator of Domino's Pizza in the growth phase setting up the franchise in Poland with moats and involvement of Domino's UK and AU. Single digit multiples.

Domino’s Pizza Poland, or DP Poland, is the master franchise holder for Poland and Croatia. The company is listed on AIM in London, but has all of its operations in Poland and Croatia and 95%+ of it in Poland, which is its de facto business. DP Poland is headquartered in Warsaw, Poland and is run by an experienced Australian Domino’s executive.

The franchise is being secretly set up under everyone’s noses as the company completed two big M&As (one in 2021 and the other now in 2025), converted the stores to Domino’s and is already the 3rd largest player (the largest one in 2 years). They’re franchising the store portfolio that’s mostly corporate for now, which will grow margins, and the company is about to turn profitable in 2026. They also have direct funding, technology and support from Domino’s UK and Australia. It’s a crazy hidden opportunity that I think you might find interesting.

Business Overview

DP Poland, or Domino’s Pizza Poland, is the exclusive master franchisee of Domino’s for Poland and Croatia. The company was founded and IPOed in 2010, and the expansion reached 60 stores by the end of 2018. The management changed fairly frequently, and nothing really happened as Domino’s Pizza system was focused on other markets. The IPO was a mistake, and even the current management doesn’t understand why it happened back then, marking it as a clear mistake. However, this anomaly has led to the unique business opportunity we can take part in as public shareholders.

The real change began in 2020 when DP Poland purchased Dominium Pizza, which was a Polish pizza chain of 57 stores founded in 1993 and one of the main competitors. The acquisition doubled Domino’s store count in Poland to 122 by the end of 2020. Dominium stores have been rebranded and converted into Domino’s since.

The second big milestone in the growth story came when, in 2022, Nils Gornal (CEO) and Edward Kaczyrz (CFO) joined the company together with Andrew Rennie (Chairman), who you might remember from my Domino’s UK post. Nils Gronal is an Aussie “Dominoid” just like Rennie, with 30 years of experience at Domino’s Australia, both as a franchisee and executive. A few years ago, he was setting up a few Domino’s stores in Croatia when DP Poland reached out to him to join them as the CEO and ended up acquiring his 3 (now 5) Croatian stores together with him.

Rennie, the current CEO of Domino’s UK, is a good friend of Gornal and helped him set up the Croatian stores. He joined as the Chairman during the same year. A few months later, Edward Kacyrz, a very honest and experienced Polish CFO, joined their team. Rennie has left since then to focus more on Domino’s UK, and David Wild, ex CEO of Domino’s UK, took over as the Chairman. However, Rennie is still involved in DP Poland, and Gornal is in close and regular touch with him.

The business has grown to 112 Domino’s branded stores in Poland, and earlier this year, they acquired Pizzeria 105, the 4th largest player in Poland, which brings 90 new stores and 76 franchisees into the network. All of them are bound to be rebranded, but more on that later. DP Poland is also in a sub-franchising process, with 16.1% of the network franchised and the rest (less profitable, especially outside of Warsaw) corporate. This number has been steadily growing, and the management expects 45% of the network to be fully franchised by the end of 2026, which will bring more profitability and margin expansion.

How does it make money?

The company makes money from the corporate store sales, sales of dough and other supplies to the franchisees, royalty fees and a rental income on their leasehold property. DP Poland is still in the process of sub-franchising the chain, with 16.1% of the stores franchised and 45% planned by the end of 2026. As such, the majority of the revenue still comes from the sales from the corporate stores (97% and 94% as of FY 2023 and 2024, respectively and 89% as of H1 2025). These stores aren’t the most efficient, as the ones outside of Warsaw are harder to manage efficiently, and you want owner-operators instead of employees with no skin in the game.

The remaining sources of revenue may seem insignificant now, but they are the most important as their share is going to rise exponentially over the next few years due to the sub-franchising process. Domino’s operates a commissary (manufacturing/logistics plant) where it produces dough and other food ingredients that it sells to the franchisees. On top of the food, these commissaries also sell fixtures and equipment. The supply sales to franchisees were 2.3%, 4.2% and 8.6% of the revenue in 2023, 2024 and H1 2025, respectively.

The company charges a royalty on total gross sales of 5.5% and 4% for the national marketing fund. It’s a classic Domino’s set up where the franchisee pays a small % of their sales to Domino’s, whilst the marketing fund contribution allows Domino’s to use scale to grow their share of voice. The royalty fee revenue was 0.6%, 0.8% and 1.3% of the revenue in 2023, 2024 and H1 2025, respectively. You can see the same pattern as with the supply chain part.

Growth Strategy